In the volatile crypto market, XRP is reaching a turning point. With the approval of the XRP ETF, market sentiment has been greatly boosted, and many investors are beginning to reassess XRP as part of their asset portfolio.

Once considered a high-risk speculative digital asset, XRP is quietly becoming part of global asset allocation, especially with the continuous improvement of cross-border payments, institutional settlements, and digital financial infrastructure, attracting more attention from institutions and investors.

Digital Assets: Reflecting Stable and Long-Term Value

As a digital asset, XRP’s market value growth is gradually shifting away from short-term fluctuations and towards stable long-term growth. Correspondingly, the KT DeFi platform is leading a more rational and sustainable investment approach, emphasizing a long-term perspective and stable cash flow.

KT DeFi discourages short-term trading or frequent speculation, and instead builds its digital asset system based on the following core principles:

Long-term perspective: Focus on the value of time rather than short-term market fluctuations.

Stability and predictability: transparent revenue structure and daily settlement.

Sustainable growth: Achieving long-term value appreciation through the compound interest mechanism.

Stable returns on digital assets

On the KT DeFi platform , investors do not need to participate in complex transactions or monitor the market. The platform provides transparent and reinvestable returns through the systematic allocation of digital asset computing resources.

Daily settlement, check your earnings anytime

Clear fund flows and controllable risk structure

Long-term returns can be improved through compound interest.

This model is more like a long-term, stable asset portfolio, avoiding high-risk speculative operations.

Green Finance and Sustainable Development

KT DeFi also prioritizes environmental protection and sustainable development. The platform’s global data centers are located in Northern Europe, Canada, and Central Asia, relying on green energy sources such as hydropower, wind power, and solar power to ensure environmental protection while reducing costs.

This green energy strategy not only enhances the platform’s long-term competitiveness but also reflects the deep integration of digital assets and the energy economy.

Compliance and security assurance

KT DeFi is registered and regulated in the UK, strictly adhering to local laws and international compliance frameworks. The platform employs a multi-layered security system, including Cloudflare and McAfee security systems, to ensure the safety of user data and assets. All contract mechanisms are automated, ensuring transparent records and clear rules.

Currently, KT DeFi serves more than 190 countries and regions and has won the long-term trust of millions of users.

How to join KT DeFi:

Top-up: Supports mainstream digital assets such as XRP, BTC, ETH, USDT, and SOL.

Choose a contract: You can participate with a minimum of $100. The system runs automatically and profits are settled daily.

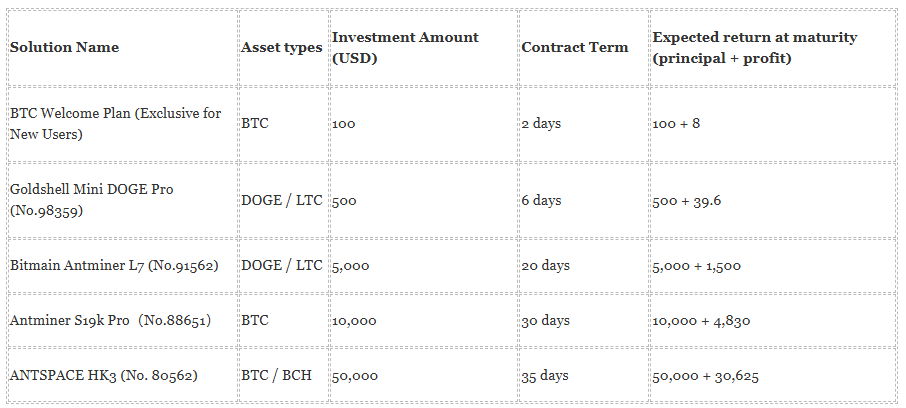

Example of potential contract revenue:

For more details, please visit the official website: https://ktdefi.com/

In conclusion, value investing has not disappeared; it has simply continued in new forms.

While traditional investment methods may be constantly evolving, the spirit of value investing remains. In the era of digital finance, the core value of investment is being perpetuated in new ways—not relying on frequent trading or chasing short-term fluctuations, but allowing time, technology, and compound interest to work together.

KT DeFi demonstrates this new investment possibility: redefining long-term, stability, and value in the world of digital assets.

Disclaimer: The information provided in this press release does not constitute an investment solicitation, nor does it constitute investment advice, financial advice, or trading recommendations. It is strongly recommended that you perform due diligence before investing or trading in cryptocurrencies and securities, including consulting a professional financial advisor.